The Future of High-Purity Extraction

Isolate. The Next Wave? The cannabis and hemp industry is shifting from “commodity crude” to “specialized isolates.” As the market matures, the ability to produce

The rescheduling of cannabis opens numerous financial doors for businesses within the industry. Previously, businesses were hindered by IRS Section 280E, which precludes companies dealing with Schedule I or II substances from deducting typical business expenses such as payroll, marketing, and rent. This restriction has led cannabis businesses to face effective tax rates far higher than those of conventional businesses, sometimes as much as 70% or higher. With the shift to Schedule III, these businesses can now deduct these expenses, aligning their tax obligations more closely with those of other legal industries, which should significantly enhance profitability and operational efficiency.

Additionally, the reclassification is expected to catalyze a shift in the banking and financial sector’s engagement with cannabis businesses. Until now, the Schedule I classification has made banks wary of providing services due to potential federal penalties. The move to Schedule III mitigates these risks, likely leading to an increase in the availability of financial services like business loans, credit lines, and more conventional banking services. This fundamental change will not only enhance the safety and scalability of these businesses by reducing the need to operate on a cash-only basis but also promote greater financial transparency and regulatory compliance.

Expanded Legal and Regulatory Changes

The reclassification of cannabis affects various legal realms, notably easing the stringent penalties and restrictions placed on users and businesses under federal law. For instance, cannabis use has previously impacted individuals’ eligibility for federal employment, as well as their ability to receive federal benefits such as housing assistance. With cannabis moving to Schedule III, these impediments are expected to be reduced, thereby lessening the legal burdens on individuals and enhancing civil liberties.

Moreover, federal employees and contractors, who were previously subject to stringent drug-free workplace policies under the Reagan-era executive orders, might see a relaxation in these policies. This change could make it easier for them to use cannabis medicinally without risking their employment. However, agencies might still set their own policies, so the actual changes might be slow and uneven across different federal departments.

Expanded Medical and Scientific Research

With cannabis reclassified to Schedule III, the landscape of medical research is poised to change dramatically. Currently, the classification as a Schedule I drug — indicating no accepted medical use — severely limits research due to high regulatory barriers and restricted funding. Researchers now anticipate easier access to cannabis for studies, which could lead to a broader understanding of its therapeutic benefits and possibly spur the development of new cannabis-based medications.

This change is also likely to influence the quality and variety of cannabis available for research, as researchers can now source from a wider array of suppliers rather than being limited to a single federal source. This could lead to more accurate and comprehensive research findings, potentially accelerating the approval of new cannabis-based therapies by institutions like the FDA.

Expanded Implications for Marketing and Consumer Perception

The shift of cannabis to a less restrictive schedule could significantly alter public perception, reducing the stigma associated with its use. For businesses, this presents an opportunity to rebrand and market their products to a broader audience, including potential customers who might have previously been deterred by the legal implications of cannabis. Companies should consider campaigns that educate the public on the benefits and safety of cannabis use, leveraging the change in legal status to shift consumer attitudes and expand their market reach.

Marketing strategies could also emphasize the enhanced legitimacy and acceptance of cannabis products, appealing to wellness and health-conscious consumers. This repositioning can be supported by scientific research and endorsements from medical professionals, which are likely to increase as the barriers to research diminish.

Preparing for Change

Cannabis businesses should proactively adapt to these changes by revising their business models and strategies in anticipation of new market dynamics. This includes exploring new business ventures, partnerships, and expansion opportunities that were previously unfeasible under Schedule I restrictions. Moreover, companies should stay vigilant about ongoing regulatory changes, maintaining compliance while seizing new opportunities for growth and innovation. Engaging with legal and industry experts can provide crucial insights and guidance during this transition, helping businesses navigate the complexities of the new regulatory environment effectively.

In summary, the reclassification of cannabis to Schedule III not only marks a significant shift in its legal standing but also opens a myriad of opportunities for the cannabis industry. Businesses that are quick to adapt and strategic in their approach can capitalize on these changes to drive growth, innovation, and wider acceptance of cannabis.

Isolate. The Next Wave? The cannabis and hemp industry is shifting from “commodity crude” to “specialized isolates.” As the market matures, the ability to produce

Why Now Is the Time to Upgrade Your Extraction System As the cannabis industry prepares for rescheduling and the next wave of regulatory and market

If you’re already running a hydrocarbon extraction lab with a decent compressor and chiller setup, there’s a good chance you’re sitting on untapped potential—and Illuminated

Protecting Your Investment in the Long Run When it comes to running an extraction lab, few things are as costly—or avoidable—as unexpected equipment failure. And

When you invest in extraction equipment, you’re not just buying steel and sensors—you’re buying the future of your lab. But not all equipment is built

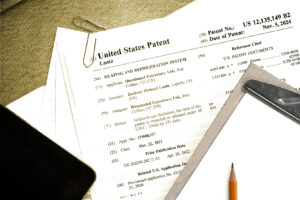

At Illuminated Extractors, we’ve never followed trends—we’ve set them. Now, with our latest innovation officially patented, we’ve secured a new frontier in extraction and refrigeration